Power & Renewables

Customer & Market Due Diligence of Electric Utility Services Company: Assessing Customer Risk, Margin Sustainability, and Growth Opportunities

Conducted 4-week phased customer & market due diligence to evaluate revenue and margin sustainability risk vis-à-vis the target’s core business and assess geographic expansion opportunities required to create a super-regional player. Developed bottom-up CapEx and Operations & Maintenance spend model of 25 key utilities, including 10-year projections; interviewed 30+ key stakeholders at the target’s top customers and potential customers; conducted detailed analysis of the target’s jobs database and forecast; and conducted extensive primary and secondary research. Based on Gotham’s findings, our PE client significantly revised down their bid and was able to secure the target at a more favorable valuation, with a top-level expansion strategy in-hand.

Show Details

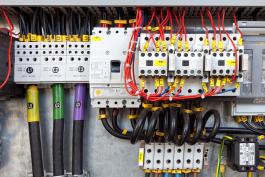

Customer & Market Due Diligence Of Electrical Connector Supplier: Establishing OEM And Utility Demand Outlook

Conducted a 2-week customer & market due diligence to establish: (1) utility end-market dynamics/trends; (2) purchasing behavior in the utility end-market; (3) data center growth outlook; and (4) competitive dynamics in the electrical connector market. To this end, Gotham: conducted interviews and surveyed distributors, manufacturers’ reps, OEMs, contractors, and utilities; built a utility electric connector product map; established electrical connector competitive landscape; established data center growth outlook; and determined utility connector demand outlook. Our fact-based utility market and competitive dynamics assessment allowed our client to gain confidence in the target’s growth outlook and was able to successfully close the deal with confidence.

Show Details

Operations Improvements at Multi-disciplinary Engineering Services Firm: Improving Profitability and Revenue Performance

Conducted a 6-week operations assessment to turn around the company’s margin performance and position it for a successful exit in 2-3 years’ time. Analyzed historical project and employee utilization performance; developed target staffing leverage model; and created target business development model to improve efficiency of business development effort while driving profitable revenue growth. Our detailed assessment gave our client a solid understanding and roadmap of the levers to achieve the target margin performance (5-7% points growth); client requested Gotham to provide ongoing support through quarterly performance audits.

Show Details

Proactive Investment Strategy In Engineering Services: Establishing A Robust Market And Competitive Fact Base For Evaluating Targets

Conducted a 4-week proactive investment strategy effort to provide a large PE client with a dependable fact base for assessing potential acquisition targets in the highly localized and fragmented engineering services market. To this end, Gotham: built a granular market sizing model and a dashboard tool to allow the investment team to visualize served addressable market size and growth rates based on a target’s end-market and geographic presence; established competitive intensity by market segment; shortlisted the 3 most promising targets from a list of 12 engineering services firms tracked by the client; and conducted ~80 interviews with engineering services buyers in geographies served by the shortlisted targets to understand the firms’ positioning. Gotham provided our client a robust fact base and tool for evaluating targets and provided the deal team a jump start in its investment process.

Show Details

Customer & Market Due Diligence Of Corn Milling Equipment Manufacturer: Establishing Market Opportunity For New Technology

Conducted a 3-week customer & market due diligence of a corn milling equipment manufacturer to provide clarity on the market opportunity for a new technology. Gotham: conducted 30 anonymous interviews with plant managers, feed merchandisers, nutritionists, and other industry participants to understand ethanol plant buying behavior and positioning of enhanced byproducts in animal feed end-markets; and established ethanol plant capacity and production over time as well as prevalence of various feed sources. By confirming a significant market opportunity for this new technology, Gotham was able to give the client confidence to move forward with their pursuit of the target.

Show Details

Customer & Market Due Diligence Of Global Precision Parts Manufacturer: Validating Revenue Sustainability In Markets Under Transformational Changes

Conducted a 2-week customer & market due diligence to validate the sustainability and growth outlook of target’s key product application/programs. To this end, Gotham: built a model to establish impact of automotive electrification on target’s business; analyzed target’s top product applications/ programs to establish growth outlook, program lifecycle, target’s positioning, and margin outlook; conducted anonymous and “warm introduction” interviews with target’s customers; reconciled target’s financial projections against market forecast to determine how much of target’s projected growth was coming from market share gains; and established competitive landscape for both mechanical and electric parts. Gotham’s work established that target’s business was sustainable and gave our client confidence to proceed with its investment.

Show Details